Last year our members struggled on filling up forms as the system collapsed and a plethora of Google forms came up in it’s place. The payment itself was probably smooth as it was done outside the website .

Last year our members struggled on filling up forms as the system collapsed and a plethora of Google forms came up in it’s place. The payment itself was probably smooth as it was done outside the website .

This year , I can vouch that the time from login to payment gateway was reduced to less than a minute and it was the payment process itself that proved difficult and time consuming.

Before I go into the nitty gritties I would like to clarify a few issues.

The Basics

1. It is not an SSS website issue. Some members actually wanted me to add the SBI or HDFC option. Sorry, it cannot be done at SSS website.

2. Gateways have agreements with banks on terms and conditions on support. It is a dynamic process.

3. Transactions fail due to a number of reasons..

one out of three cases failed in transactions by our members and major reason on our case is ‘Customer drop out ‘ not ‘Bank Failure’

The Process

1. Payment initiated .

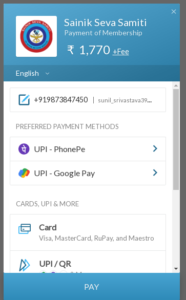

Member enters an amount and communicates with api (UPI, card ,net banking)

2. Payment authorised. Bank asks for OTP etc to verify before confirming the payment.

3. Payment captured . After due verification by the bank, razorpay captures the payment.

It takes another day or too to pass on this amount to SSS bank account, which is called the settlement process.

What can go Wrong

There are more things that can go wrong than go right as there are a number of agencies involved even in a simple transaction. Many developed countries have not achieved this level of digital transactions, as Bharat has.

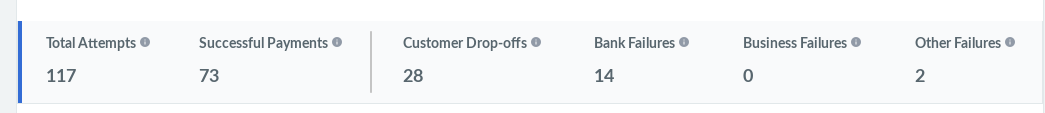

I give a screenshot of actual attempts to make payments during last one week on our web site.

As can be seen there have been 44 failures out of 117 attempts. here I might add that for someone who routinely does these transaction, the failure rate is not that high. With all modesty, I say, I have had 18 out of 19 transactions through successfully on the same platform, mainly because of following a right procedure, and using devices that work for me. (A Laptop computer could be a big pain while an Android phone could do wonders) It is during that one failure , that I learnt a lot about the payment gateway.

It can also be seen that 28 of the 44 are due to customer drop-offs.

Causes for Payment Failures

1. Most of the failures happen between initiation and authorisation..due to OTP issues , filling of incorrect card details.

2. The next cause is failure / non availability of bank’s server.

3. In rare cases, after authorisation by the bank, razorpay keeps the payment on hold or captures after a long delay. (During this time , SSS application misses the payment and no receipt is generated for the user)

What can be done by the user

1. Every user has one app or card that he can rely on fully.

2. Ensure that your browser permits javascript and there are no firewall etc blocking a web site. It is not just one site , but a number of sites that your system communicates with during a transaction, not to mention a number of advertisements being pushed on to your screen by javascripts.

(What works for me best is to fill an application or place an order on laptop – browser but do the actual payment using a smartphone and gpay.)

That’s the reason there’s not many failures when we pay at a retail store using QR code; something that even a thele-wala is comfortable with.

3. Ensure your internet is ok. One doesn’t need a blazing speed but it should be reliable.

4. In case of a failure, don’t try again immediately ( unlike an ticket for airfare , the premiums don’t rise with demand, so there’s no need to hurry or panic)

Try after an hour or so. By then the earlier attempt by you might have gone through.

5. If one app or card does not work, try another method .

What can be done by SSS

1. Go for additional gateway so that maximum banks are covered.

2. Have a system in place for manual entry of razorpay transactions which ensures automatic generation of Receipt.

Feedback and comments welcome.

Thanks.

Note

Adding a short video of payment through QR Code.

Leave a Reply